Conservatives introduce GST to Insurance Industry

Canada’s insurance industry is being forced to pay a $1 billion GST bill by the end of the month, one many companies never had to pay before. Critics say the move smacks a “banana republic.” For a party that claims it is the low tax party, this government has introduced hidden tax hikes and new taxes.

The new tax is retroactive and will be applied for the past 7 years, dating back to 2005.

Critics say the “massively distortive” tax grab tells global investors that Canada is no place to do business.

“I have lost count of the number of times that global tax directors have used the words ‘banana republic’ when I describe this legislation to them,” says Michael Firth, a tax partner at PricewaterhouseCoopers Canada, and chief among the critics.

“They don’t believe it. They go, ‘You’re kidding me? Can they really do this?'”

The Finance Department said it hasn’t changed GST legislation since its creation in 1991 by former Conservative Prime Minister Brian Mulroney’s government.

The tax modification started with a 2003 Tax Court ruling that sided with insurer State Farm against the Canada Revenue Agency where the company argued some financial transactions didn’t require the GST and thus it owned no money.

On November 17, 2005, the Finance Department released a background document recommending the GST be amended to overrule the court’s ruling, warning the modifications would be retroactive to this date.

The controversial draft legislation surfaced on January 26, 2007, well into the Conservatives’ first minority government. The measure was then passed in an omnibus budget bill in 2010, retroactively forcing GST on some financial services.

However, the GST remains as confusing and open-ended as it was when the Conservatives first created it and only last year did the insurance companies realize they had been struck with a $1 billion bill.

“In discussions I have had with affected insurers, most only became aware of the issue in 2012,” Denis Brown of MSA Research Inc. wrote in an industry newsletter this April.

“Like me, many did not take it seriously until December of 2012, always assuming that wiser heads at Revenue and Finance would intervene and fix the problem.”

The rules directly affect companies with cross-border transactions that do business with related businesses for reinsurance.

Establishing the owing has also been tricky as there is no consensus on what is taxable and what is not.

Joel Baker, president and CEO of MSA Research Inc said 2012 would cost $200 million alone and with retro-activity, would cost $1 billion. He adds not all companies will be effected and the impact on premiums for consumers remains unclear – although it is certain they can only go up. Don’t forget, this will likely effect home insurance, car insurance, life insurance and a slew of other insurance services Canadians rely on. The next increase to these premiums can only be attributed to the Conservative Party.

Many of the effected companies are in Ontario, where federal and provincial treasuries will benefit due to a 13% HST.

“The unduly expansive and retroactive application of this initiative based upon a 2005 news release, creates an unreasonable and unmanageable retroactive liability that is incompatible with the commercial certainty that should be inherent in tax policy,” Frank Swedlove, president of the Canadian Life and Health Insurance Association Inc., complained to Finance Canada in a letter last August.

Finances Canada insists GST rules haven’t been changed.

The GST amendments “were introduced in response to court decisions that extended tax relief beyond what was intended under the GST/HST,” spokeswoman Stephanie Rubec said in an email. “The amendments did not change tax policy in this area.”

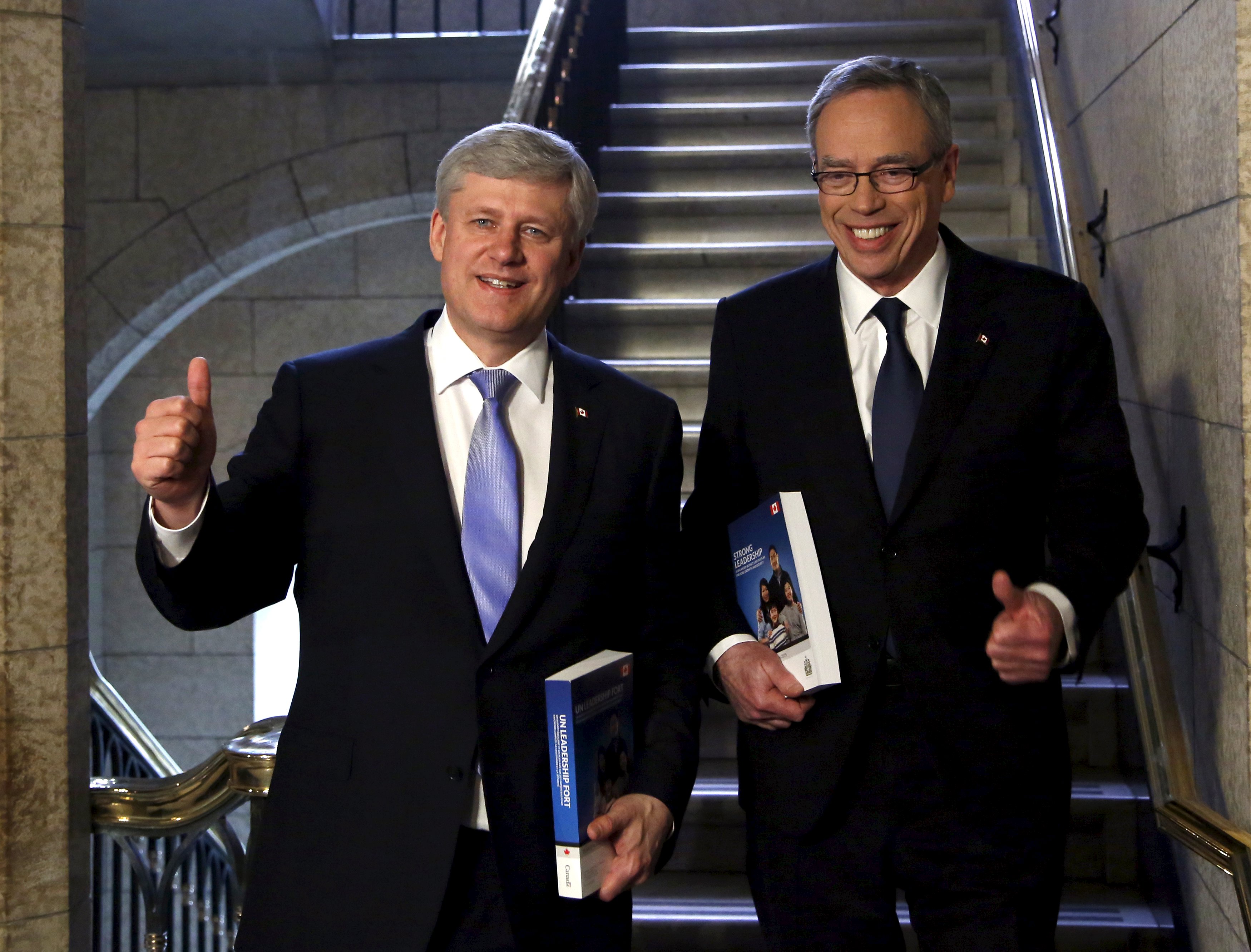

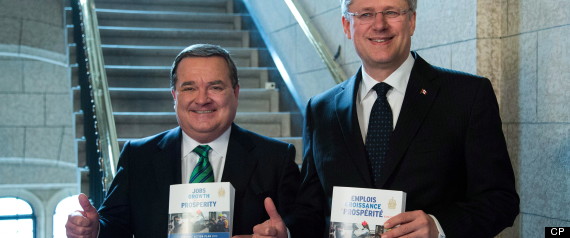

The insurance industry is hoping Flaherty will save them by June 30 but seeing how it was the Conservatives that introduced the GST and it was in Flaherty’s own budget where these tax changes were introduced, along with a slew of other, hidden, tax hikes, they shouldn’t get their hopes up.

Finance Canada created an internal group last year geared towards reviewing how the GST impacts the financial sector that has long been exempt from the regressive tax.

Firth describes Canada’s tightening of financial sector tax law to be the polar opposite of actions the European Union is taking. In Europe, tax laws are so tight countries lost competitiveness and the economy remains sluggish as a result. While Europe aims to get the government out of the way of business, the Conservatives here in Canada aim to expand tax laws on them.

Firth also notes that Canadian politicians are also well aware that Canadians have little sympathy for big business, something that if taken too far could lead Canada to the disastrous economic state the European Union is in right now.

“The government seems to be confident that if you extinguish the rights of financial institutions, it is an unattended funeral,” Firth said.

The Conservative Record on Taxes:

1991: 7% GST is introduced.

2006: GST lowered to 6%

Income Trusts taxed despite promises not to tax it

2008: GST lowered to 5%

2010: GST expanded to insurance industry among others

2011: Conservatives raise EI Premiums, essentially taxing job creation

2013: Import tariffs raised, raising prices at the store on virtually everything